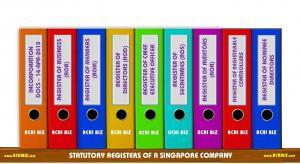

Statutory Registers of a Singapore Company

Statutory Registers of a Singapore Company

The Singapore Companies Act requires every company to maintain certain registers. These statutory registers are a part of the company’s informative records and are usually maintained as official books together with the Constitution of the Company, Share Certificates, Common Seal, all Minuted Resolutions, etc.

Registers available with ACRA

However certain registers are available either for purchase for a fee or free from the regulatory authority ACRA with effect from 03-Jan-2016.

| Following is the list of available registers from ACRA: |

| Name of Registers | Details of Registers |

Register of Business / Company Documents | - This electronic report provides a chronological list of various lodgements made by a business or company since registration. It includes the dates and descriptions of lodgements such as Annual Returns, Memorandum & Articles of Association, Change of Company Directors.

|

Register of Members (ROM) | - With effect from 3 Jan 2016, the Registrar shall, in respect of every private company, keep and maintain an electronic register of members (EROM) of that company containing such information notified to the Registrar on or after that date.

- Any entry in the EROM is prima facie evidence of the truth of any matters which are by the Act directed or authorised to be entered or inserted into the EROM.

- A private company is required to notify the Registrar of the information to be entered in the EROM.

- Therefore, please note that until the company provides complete information to the Registrar, its EROM may not contain any information or may only contain partial information. Please approach the company directly if you wish to have access to its existing register of remembers and the historical information kept in it.

- This electronic report displays the members linked to a non-gazetted exempt private company incorporated under Companies Act. Details such as member name, shareholder information, date of allotment, type of share, etc are included.

- For gazetted exempt private companies, only the Directors / Chief Executive Officer / Secretary / Auditor / Members are allowed access to the ROM.

|

Register of Directors (ROD) | - This electronic report displays the directors linked to a company. Details such as director name, date of appointment, date of cessation are included. This is available for all companies.

|

Register of Chief Executive Officers (ROCEO) | - This electronic report displays the Chief Executive Officers (CEO) linked to a company. Details such as CEO name, date of appointment, date of cessation, etc are included. This is available for all companies.

|

Register of Secretaries (ROS) | - This electronic report displays the secretaries linked to a company. Details such as secretary name, date of appointment, date of cessation, etc are included. This is available for all companies.

|

Register of Auditors (ROA) | - This electronic report displays the auditors linked to a company. Details such as auditor name, date of appointment, date of cessation, etc are included. This is available for all companies.

|

Note: - Company officers and its members have free access to all of the company’s registers (excluding Register of Business / Company Documents).

- To apply for the fee waiver, you must login to ACRA website using SingPass or CorpPass and purchase these registers from ACRA iShop.

|

Mandatory Registers to be maintained by the Entities

Mandatory Registers to be maintained by the Entities

Following is the list of Registers which are required to be prepared and maintained mandatorily by the entities w.e.f. 31-Mar-2017:

Requirement for Companies, Foreign Companies and Limited Liability Partnerships to maintain Register of Registrable Controllers |

| Name of Registers | Details of Registers |

Register of Registrable ControllersAndFiling Requirements for Register of Controllers (RORC) (W.e.f: 30-July 2020) | - With effect from 31 March 2017, companies, foreign companies and LLPs (unless exempted) will be required to maintain beneficial ownership information in the form of a register of registrable controllers, and to make the information available to public agencies upon request.

- The aim is to make the ownership and control of corporate entities more transparent and reduce opportunities for the misuse of corporate entities for illicit purposes.

- This will bring Singapore in line with international standards, and boost Singapore’s on-going efforts to maintain our strong reputation as a trusted and clean financial hub.

- In line with international practices, ACRA has implemented a new requirement for all companies, foreign companies and Limited Liability Partnerships (LLP), unless exempted, to lodge information on their Registers of Registrable Controllers (RORC) with ACRA via BizFile+ from 30-July 2020.

- This is in addition to the existing requirements for companies and LLPs to maintain a RORC at the registered office address.

|

Register of Nominee Directors | - With effect from 31 March 2017, Companies are required to each:

- Keep a register of its nominee directors containing the particulars of the nominators of the company’s nominee directors; and

- Produce the register of nominee directors and any related document to the Registrar, an officer of the Accounting and Corporate Regulatory Authority or a public agency, upon request.

- Unlike the register of controllers for companies, companies are not required to take reasonable steps (including sending out notices) to identify their nominee directors, or to update or correct inaccuracies in the particulars contained in their registers of nominee directors.

- Instead, nominee directors are required to inform their respective companies of the fact that they are nominees and provide the prescribed particulars of their nominators to their companies within the applicable timelines.

|

Notes: - It is mandatory obligation for the company to declare with ACRA while filing the Annual Return about whether the company is exempted from keeping the above two registers or not.

- If the company is not exempted from keeping the above two registers, then the company should declare where the both the registers are being kept either at the Registered Address of the Company or at the Registered Address of the Filing Agent appointed by the company for the purpose of keeping both the registers.

- Companies, foreign companies and LLPs are required to continue to maintain a RORC at the registered office address, and update any changes to the RORC information prior to updating the same information with ACRA within two business days. Alternatively, a Registered Filing Agent (RFA) may be engaged to lodge the RORC information with ACRA on behalf of the entity.

Who can lodge RORC information on behalf of business entities?- Only authorised position holders of the business entity (e.g. directors and secretaries of company / partners of LLPS) as well as RFAs that have been authorised by the business entity can lodge RORC information in BizFile+.

RFAs Lodging RORC information on behalf of their clients- RFAs can only perform transactions, including lodging of RORC information, for entities which are in the client list submitted to ACRA. RFAs must ensure that they have been authorised by their clients to lodge and update the RORC information on their behalf.

Is there a need to update information of past controllers whom have already ceased to be controllers of the entity?- Particulars of previous controllers should also be uploaded with ACRA as previously identified. The date which they ceased to be controllers should also be updated accordingly.

Is there any penalty for late lodgement?- There is no penalty for late lodgement for this transaction. However, entities that are found to have failed to lodge RORC information with ACRA within the deadline, may face enforcement action with a fine up to $5,000 upon conviction.

What are the penalties for failing to lodge RORC with ACRA?- The companies/LLPs will be guilty of an offence, and shall be liable upon conviction, to a fine not exceeding $5,000.

|

FAQ on Register of RC & Register of ND

FAQ on Register of RC & Register of ND

The following Frequently Asked Questions may help you understand on the statutory requirements of Register of Registrable Controllers and Register of Nominee Directors.

How to identify the registrable controller? | - Company may write to all its legal owners (shareholders) as well as directors and ask whether they are controllers or know anyone who is a controller, by sending that person a notice. For a majority of companies, their shareholders are likely to be the controllers. Therefore the names that they will reflect in their registers of controllers will be the same as the names on their registers of members.

|

Is dormant company exempted from maintaining the registers of registrable controller? | - No. Dormant company is also required to maintain the register of registrable controllers which cannot be exempted.

|

Who can view the register of registrable controllers? | - The company’s officers are able to view the register of registrable controllers. The officers are the ones responsible for maintaining the register.

- The shareholders will not be able to view the register as the register is not meant for public viewing.

|

Who is registrable controller? | - A controller is an entity that has either significant interest in, or significant control over the company. This controller can be either an individual (i.e. a person in natural) or a corporate body (e.g. another entity).

- According to the Companies Act, an entity has a significant interest in a company with a share capital if it:

- Has an interest in more than 25% of the shares in the company; or

- Has an interest in one or more voting shares in the company, and the total number of votes attached to that share(s) is more than 25% of the voting power in the company.

- Shareholders who hold more than 25% of the shares in a company are considered to have a significant interest in that company. They are therefore controllers of the company.

- If an entity without a share capital, an entity will have a significant interest in your company if it holds, whether directly or indirectly, a right to share in more than 25% of the company’s capital or profits.

- On the other hand, an entity has a significant control in a company if it:

- Directly or indirectly holds the right to appoint or remove the directors who hold a majority of the voting rights at directors’ meetings on all (or substantially all) matters;

- Directly or indirectly holds more than 25% of the rights to vote on matters which are to be decided through a vote of that company’s members; or

- Has the right to exercise, or actually exercises, significant influence or control over the company.

- Company directors are, in common, controllers because they generally have significant control over their companies.

- When a company director does not have significant control over the company, he may instead be a nominee director, who will be registered in the Register of Nominee Directors instead.

|

Who should notify the nominee directorship? | - For the purposes of maintaining the Register of Nominee Directors, Nominee directors are required to inform their companies of their nominee directorship.

- Nominee directors are now required to inform their companies of their status as the company’s nominee director and provide certain particulars of his nominator to be written into the Register of Nominee Directors with certain deadlines.

|

Whom the register to be produced? | - Companies should produce the register of nominee directors and any related document to the Registrar, an officer of the Accounting and Corporate Regulatory Authority or a public agency, upon request.

|

Maintaining the Registers by the Entities

Maintaining the Registers by the Entities

Generally, the private companies in Singapore are still maintaining their own registers despite being most of the registers maintained by ACRA. The reasons for maintaining their own registers vary from companies to companies. However, the common public perception is that maintaining with their own full set of Statutory Register together with the Constitution of the Company, Share Certificates, Common Seal, all Minuted Resolutions, Register of Registrable Controllers, Register of Nominee Directors, etc will be very handy informative records to the authorised representatives of the companies.

Seeking professional service provider for construction of Statutory Registers

Where your existing Private Limited Company has not yet maintained with the full set of Statutory Registers for whatever the reasons, ACHI BIZ could assist you to adherence with compliance for constructing such registers with necessary documents even if some are missing during the course of business set up.

Hence, many shareholders and directors in private companies prefer to engage a Corporate Service Provider (CSP) like ACHI BIZ to assist with construction of full set of Statutory Registers including the Constitution of the Company, Share Certificates, Common Seal, all Minuted Resolutions, Register of Registrable Controllers, Register of Nominee Directors, etc and for various other matters which may arise in the course of the transaction.

Please refer to SERVICES if you wish to proceed or CONTACT us for more information.

Statutory Registers of a Singapore Company

Statutory Registers of a Singapore Company Mandatory Registers to be maintained by the Entities

Mandatory Registers to be maintained by the Entities FAQ on Register of RC & Register of ND

FAQ on Register of RC & Register of ND Maintaining the Registers by the Entities

Maintaining the Registers by the Entities