Contributions to Self-Help Groups (SHGs) and SHARE Donations (Community Funds) in Singapore

Contributions to Self-Help Groups (SHGs) and SHARE Donations (Community Funds) in Singapore

CPF Board is the collecting agent for contributions to self-help group (SHGs) funds and SHARE donations. These contributions and donations are deducted from your employee’s wages together with the employee’s share of CPF contribution.

What are Self-Help Group (SHG) Funds?

The Self-Help Groups (SHGs) are set up to uplift the less privileged and low income households in the Chinese, Eurasian, Muslim and Indian communities respectively.

The SHGs Funds are as follow:

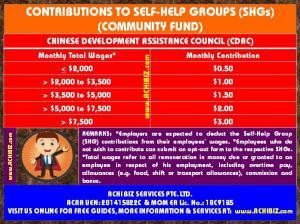

Chinese Development Assistance Council (CDAC) Fund, administered by CDAC

For the Chinese Development Assistance Council (CDAC) Fund, employees refer to Singapore Citizens and Permanent Residents, belonging to the Chinese community.

The contribution rates for CDAC are as follows:

| Monthly Total Wages* | Monthly Contribution |

| <= $2,000 | $0.50 |

| > $2,000 to $3,500 | $1.00 |

| > $3,500 to $5,000 | $1.50 |

| > $5,000 to $7,500 | $2.00 |

| > $7,500 | $3.00 |

* Total wages refer to all remuneration in money due or granted to an employee in respect of his employment, including overtime pay, allowances (e.g. food, shift or transport allowances), commission and bonus.

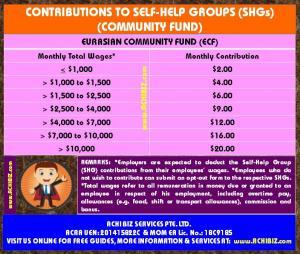

Eurasian Community Fund (ECF), administered by the Eurasian Association (EA)

For the Eurasian Community Fund (ECF), employees refer to Singapore Citizens and Permanent Residents, belonging to the Eurasian* community.

* Refers to a person defined as “Eurasian” in their identity card, or a person of both European and Asian ancestry

The contribution rates for ECF are as follows:

| Monthly Total Wages* | Monthly Contribution |

| <= $1,000 | $2.00 |

| > $1,000 to $1,500 | $4.00 |

| > $1,500 to $2,500 | $6.00 |

| > $2,500 to $4,000 | $9.00 |

| > $4,000 to $7,000 | $12.00 |

| > $7,000 to $10,000 | $16.00 |

| > $10,000 | $20.00 |

* Total wages refer to all remuneration in money due or granted to an employee in respect of his employment, including overtime pay, allowances (e.g. food, shift or transport allowances), commission and bonus.

Mosque Building and Mendaki Fund (MBMF), administered by Majlis Ugama Islam Singapura (MUIS)

For the Mosque Building and Mendaki Fund (MBMF), it is applicable to all working Muslims in Singapore – regardless of race and nationality, which includes permanent residents and foreign workers either on an Employment Pass or a Work Permit.

For a working Muslim who is contributing to either the Chinese Development Assistance Council (CDAC) or the Singapore Indian Development Association (SINDA) in addition to the MBMF, he/she has the option to continue contributing or opt-out from either fund. He/she will then have to submit an opt-out form to the relevant agencies.

The contribution rates for MBMF are as follows:

| Monthly Total Wages* | Monthly Contribution |

| <= $1,000 | $3.00 |

| > $1,000 to $2,000 | $4.50 |

| > $2,000 to $3,000 | $6.50 |

| > $3,000 to $4,000 | $15.00 |

| > $4,000 to $6,000 | $19.50 |

| > $6,000 to $8,000 | $22.00 |

| > $8,000 to $10,000 | $24.00 |

| > $10,000 | $26.00 |

* Total wages refer to all remuneration in money due or granted to an employee in respect of his employment, including overtime pay, allowances (e.g. food, shift or transport allowances), commission and bonus.

The MBMF comprises three components:

- The Mosque Building component is used to build new mosques, upgrade and redevelop current mosques.

- The Mendaki component is used to develop educational and social programmes to strengthen and uplift Malay/Muslim families.

- The Religious Education component is used to support current and future religious education needs of the Muslim community.

Singapore Indian Development Association (SINDA) Fund, administered by SINDA

For the Singapore Indian Development Association (SINDA) Fund, employees refer to all working Indians in Singapore who are Singapore Citizens, Permanent Residents and Employment Pass holders and are of Indian descent (including Bangladeshis, Bengalis, Parsees, Sikhs, Sinhalese, Telegus, Pakistanis, Sri Lankans, Goanese, Malayalees, Punjabis, Tamils, Gujaratis, Sindhis and all people originating from the Indian sub-continent).

Politically, the Indian subcontinent includes Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka.

The contribution rates for SINDA are as follows:

| Monthly Total Wages* | Monthly Contribution |

| <= $1,000 | $1.00 |

| > $1,000 to $1,500 | $3.00 |

| > $1,500 to $2,500 | $5.00 |

| > $2,500 to $4,500 | $7.00 |

| > $4,500 to $7,500 | $9.00 |

| > $7,500 to $10,000 | $12.00 |

| > $10,000 to $15,000 | $18.00 |

| > $15,000 | $30.00 |

* Total wages refer to all remuneration in money due or granted to an employee in respect of his employment, including overtime pay, allowances (e.g. food, shift or transport allowances), commission and bonus.

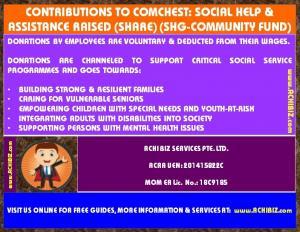

What is Social Help and Assistance Raised by Employees (SHARE)?

What is Social Help and Assistance Raised by Employees (SHARE)?

SHARE is a monthly giving programme of Community Chest, the fund-raising and engagement arm of the National Council of Social Service. On behalf of Community Chest, the CPF Board collects employee’s donations to SHARE from employee’s wages made through the company payroll.

Donations by employees are voluntary and deducted from their wages. 100% of the donations are channelled directly to support critical social service programmes and goes towards:

- Building strong and resilient families

- Caring for vulnerable seniors

- Empowering children with special needs and youth-at-risk

- Integrating adults with disabilities into society

- Supporting persons with mental health issues

Must I contribute to the Self-Help Group (SHG) Funds?

Employers are expected to deduct the Self-Help Group (SHG) contributions from their employees’ wages. Employees who do not wish to contribute can submit an opt-out form to the respective SHGs.

For the Chinese Development Assistance Council (CDAC) Fund, employees refer to Singapore Citizens and Permanent Residents, belonging to the Chinese community.

For the Singapore Indian Development Association (SINDA) Fund, employees refer to all working Indians in Singapore who are Singapore Citizens, Permanent Residents and Employment Pass holders and are of Indian descent (including Bangladeshis, Bengalis, Parsees, Sikhs, Sinhalese, Telegus, Pakistanis, Sri Lankans, Goanese, Malayalees, Punjabis, Tamils, Gujaratis, Sindhis and all people originating from the Indian sub-continent). Politically, the Indian subcontinent includes Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka.

For the Mosque Building and Mendaki Fund (MBMF), it is applicable to all working Muslims in Singapore – regardless of race and nationality, which includes permanent residents and foreign workers either on an Employment Pass or a Work Permit.

For a working Muslim who is contributing to either the Chinese Development Assistance Council (CDAC) or the Singapore Indian Development Association (SINDA) in addition to the MBMF, he/she has the option to continue contributing or opt-out from either fund. He/she will then have to submit an opt-out form to the relevant agencies.

For the Eurasian Community Fund (ECF), employees refer to Singapore Citizens and Permanent Residents, belonging to the Eurasian* community.

* Refers to a person defined as “Eurasian” in their identity card, or a person of both European and Asian ancestry

Can my employees contribute a different amount to the Self-Help Group (SHG) or opt-out?

If your employee wishes to contribute a different amount or opt-out, the employee has to obtain the relevant form from the applicable Self-Help Group (SHG).

How do I pay my employees’ contributions to the Self-Help Group (SHG) Funds and SHARE donations?

Employers are expected to deduct the contributions from their employees’ wages. This is similar to the approach on how they would deduct the employee’s share of CPF contributions.

Thereafter, employers can pay the contributions to Self-Help Group (SHG) Funds and SHARE donations, together with CPF contributions to CPF Board.

How do I apply for a refund of excess payment made to the Self-Help Group (SHG) Funds and SHARE donations?

You should approach the relevant agencies directly for a refund of excess payment.

Chinese Development Assistance Council (CDAC)Address: 65 Tanjong Katong Road, CDAC Building, Singapore 436957 Website: www.cdac.org.sg |

Eurasian Community Fund (ECF)Address: 139 Ceylon Road, The Eurasian Association (Singapore), Eurasian Community House, Singapore 429744 Website: www.eurasians.org.sg |

Mosque Building and Mendaki Fund (MBMF)Address: 273 Braddell Road, Majlis Ugama Islam Singapura, Singapore Islamic Hub, Singapore 579702 Website: www.muis.gov.sg |

Singapore Indian Development Association (SINDA)Address: 1 Beatty Road Singapore 209943 Website: www.sinda.org.sg |

Community Chest – SHARE ProgrammeAddress: 170 Ghim Moh Road, #01-02 National Council of Social Services, Ulu Pandan Community Building, Singapore 279621 Website: www.comchest.sg |

You may wish to visit Central Provident Fund (CPF) or to use Employer related various Calculators online for detailed information and current updates.

24/7/365

24/7/365