Generally, payroll processing represents the accounting system that connects your employees, various agencies that collect taxes on the sum you pay to your employees and also your business. It is extremely important to have a precise payroll process because it makes you fully accountable to your partners. As you will have clean records, precise payroll helps you to stay stress-free at the time of tax paying.

Generally, payroll processing represents the accounting system that connects your employees, various agencies that collect taxes on the sum you pay to your employees and also your business. It is extremely important to have a precise payroll process because it makes you fully accountable to your partners. As you will have clean records, precise payroll helps you to stay stress-free at the time of tax paying.

Why Is Precise Payroll Important?

Precise payroll processing is very important for any organisation.

Ethics:

Precise payroll helps you to stay ethical in your business. Hiring employees involves entering a contractual relationship agreeing to compensate the employees for their work and pre-agreed terms like hourly wages or salary. Inaccurate payrolls fail to compensate the employees whatever is promised and it is a form of stealing funds, which rightfully belong to them.

Feedback:

Precise payroll helps you to evaluate if your business is making enough profits or not. Ideal payroll percentage might vary for different businesses, but any business that is not earning profit must evaluate its payroll and introduce ways to improve profitability. Accurate payroll helps to introduce cost-efficient changes with ease.

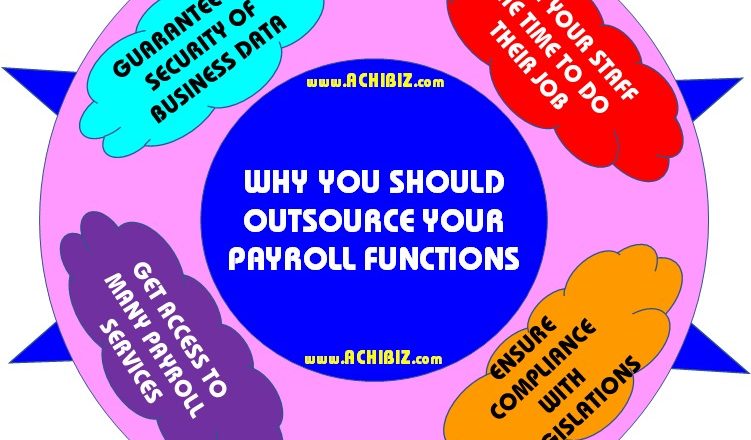

Now that you have understood the importance of precise payroll processing, let’s move on to understand how outsourcing can help in achieving this.

How Can Outsourcing Payroll Processing Help in Precise Payroll Processing?

How Can Outsourcing Payroll Processing Help in Precise Payroll Processing?

Here’s how the outsourcing of payroll processing can help in precise payroll processing:

Keep an Eye on the Changing Rules:

Most of the times, internal payroll processing departments in an organization do not have a track of the changing rules and regulations. Outsourcing payroll will help you to get precise payroll that abides by the latest government rules and regulations. By doing so, you can save on taxes.

Avoid Penalties:

There are times when the internal payroll department fails to pay on time or have incorrect filings in the payroll. This is the reason why 40% of the businesses pay penalties to the government. Outsourcing the payroll can help you to avoid penalty and give your business a tax guarantee.

Trim Costs:

Usually, having an internal payroll processing team incurs heavy costs for businesses. On the other hand, outsourcing payroll processing can help the business to reduce the direct costs involved and hence the companies can save up on additional costs and utilize their in-house resources in an efficient way.

These are some of the many advantages of outsourcing your payroll processing system. While you can manage your company resources by hiring in-house candidates who can help in managing the financial aspects of the company, it is always advisable to have the payroll processing outsourced while you are busy scaling up your business.

How Can Outsourcing Payroll Processing Help in Precise Payroll Processing?

How Can Outsourcing Payroll Processing Help in Precise Payroll Processing?